Community Financing for a Better Future

Empowering communities through zero-interest and a secured democratic financial solution

Signup for early Perks.

What is OneMAI?

OneMAI is a platform designed for you to revolutionize community-based financing. By modernizing traditional rotational savings, OneMAI provides a secure, transparent and democratic way for communities to pool funds for personal and shared goals towards achiving financial independence. A blend of technology and your trusted community for financial inclusion.

Our Mission

To empower communities and groups by providing an inclusive financial platform that promotes trust, financial growth and sustainable processes. OneMAI aims to bridge the gap in financial inclusion and create a future where everyone can achieve their financial goals collaboratively.

How It Works

Get started with OneMAI in four simple steps

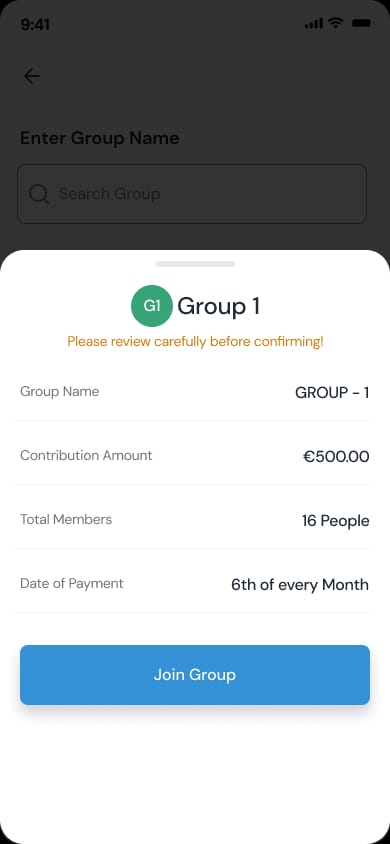

Create and Join a Community

Start by creating your own community or joining an existing one. Connect with like-minded individuals who share your financial goals.

- Create a new community in minutes

- Join existing communities

Set Community Rules

Establish clear guidelines and rules for your community to ensure smooth operation and build trust among members.

- Define membership criteria

- Set governance structure

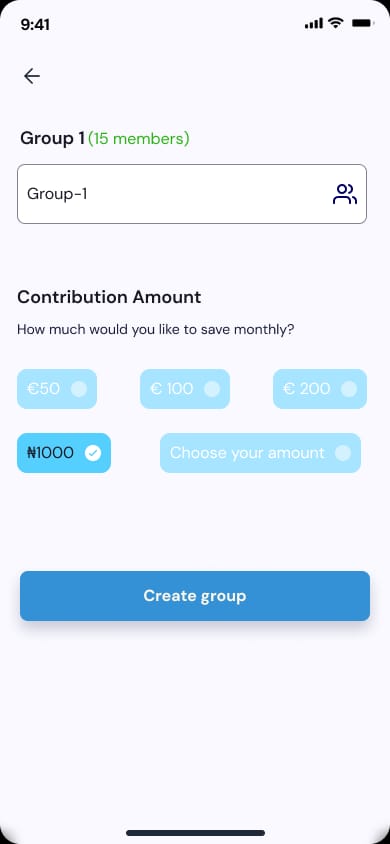

Set Pooling and Withdrawal Parameters

Configure contribution amounts, frequency, and withdrawal rules that work for your community.

- Set contribution schedules

- Define withdrawal criteria

Pool and Receive Funds

Start contributing to the pool and receive funds according to your community's established rules.

- Automated contributions

- Transparent fund distribution

Community Impact Survey

Already signed up for OneMAI release

Believe OneMAI will be more reliable than traditional rotational savings method

They most likely will achieve personal financial goals ahead of schedule

Success Stories

Real stories from our community members who transformed their financial future

Arjun's Story

Small Business Owner

"OneMAI will help me secure interest-free financing for my small business at Martim Moniz. The community support will grow , and the transparent system will give me peace of mind."

Achieved business expansion goal in 8 months through community funding

Sarah's Journey

Community Leader

"Traditional savings groups were challenging to manage. With OneMAI, everything will be automated and secure. Our community will surely grow stronger."

Managing a 50-member savings group successfully for 2 years

Santos's Success

Student

"Before OneMAI, I struggled with traditional rotating savings groups. Now, I can easily track contributions and access funds when needed."

Funded education through community support

Partners

Ready to Transform Your Community's Financial Future?

Join thousands of communities already benefiting from OneMAI's innovative financial solutions

Early Access

Be among the first to experience the future of community financing

Join the Community

Connect with like-minded individuals and start your financial journey

Stay Updated with Our Progress

Frequently Asked Questions

Find answers to common questions about OneMAI

OneMAI is a community-driven financial platform modernizing informal savings systems. Users pool money in groups and take turns accessing funds, ensuring transparency and security through advanced technology.

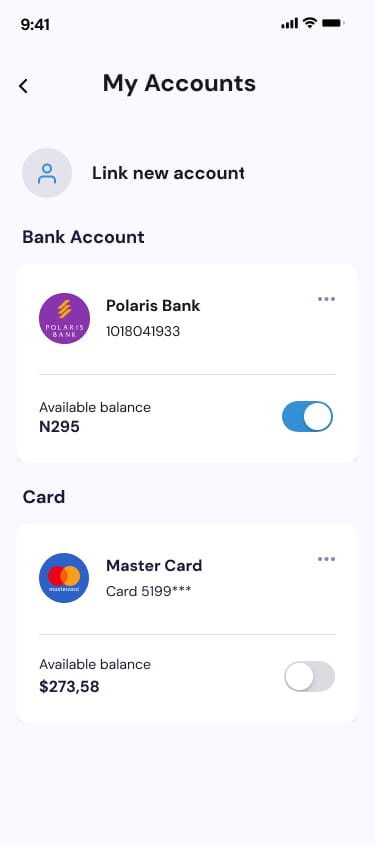

Unlike banks or loan services, OneMAI offers zero-interest savings and loans, uses blockchain for secure transactions, and provides customizable savings groups tailored to your needs.

Yes, We are partnered with insured financial institutions (Local and International Banks) to ensure your funds are safe at all times. OneMAI does not handle funds withholding, financial institutions does. The OneMAI platform also leverages blockchain technology and strict encryption protocols to ensure all transactions are transparent, secure, and tamper-proof.

Absolutely! You can create or join savings groups based on your financial goals and invite trusted participants.

OneMAI uses AI-powered risk assessment to minimize defaults and provides backup options to safeguard group funds.

OneMAI charges a service/withdrawal fee between 0.5-2%.

OneMAI empowers users with financial independence, reduces reliance on predatory loans, and promotes financial literacy, aligning with ESG (Environmental, Social, Governance) goals.

Companies can offer OneMAI as a financial cooperative platform for employees, fostering financial well-being, improving productivity, and enhancing retention.

OneMAI is fully compliant with EU financial and data protection regulations, ensuring secure and lawful operations across all markets.

OneMAI provides employees with access to savings tools, zero-interest loans, and financial literacy programs, promoting financial security and trust.

Partners can access engagement reports, group performance data, and impact metrics to evaluate the program's success.

Contact Us

Have questions? We're here to help. Reach out to us through any of these channels.

Join Us On Social Media